So you’ve had a killer idea, launched your side hustle and that monkey on your shoulder keeps nagging at you. Should I be paying tax? Am I supposed to be keeping those receipts instead of fishing the soggy residue out of the washing machine?

We’ve all been there. Paying accountants is never fun, but they are actually quite useful human beings. What’s more, they may even save you money in the long run. Check out our ultimate guide on how to find an accountant in the UK with these 9 top tips.

Find an Accountant Using An Accountant Marketplace

One of the easiest ways to find an accountant in the UK is to use a trusted marketplace. By using a marketplace you can enter your requirements, decide if you want a firm or individual that is local to you and most importantly read reviews from previous customers.

Unbiased

Unbiased is finance focussed who specialise in matching accountants, bookkeepers, financial advisors and mortgage brokers with new clients. Simply fill out the quick questionnaire outlining your requirements and they will match you with potential partners. There is no obligation to take any proposal and is an excellent place to start your search.

Bark

Bark was founded in 2014 and helps match professionals with clients and has considerable expertise in helping match clients with accountancy services.

Try All in One Accountancy Software as a Service Platforms

SAAS products are a growing trend at the moment and with accountancy it’s no different.

An accountancy SAAS platform combines the roles of a traditional accountant with accountancy software. All submissions are done inside the platform. this means you don’t need a separate accountant and software.

These platforms do have qualified accountants on hand to help with anything along the way (although there may be an additional charge).

With an Accountancy SAAS platform you pay a fixed monthly fee meaning no nasty surprises.

The benefits of using an accountancy SAAS is that you know where you stand in terms of monthly cost and the price can scale as you grow your business. They are often cheaper than using a traditional accountancy firm too, although they can lack the personal touch and you won’t be able to have face to face time.

Here are 2 SAAS accounting platforms worth looking at:

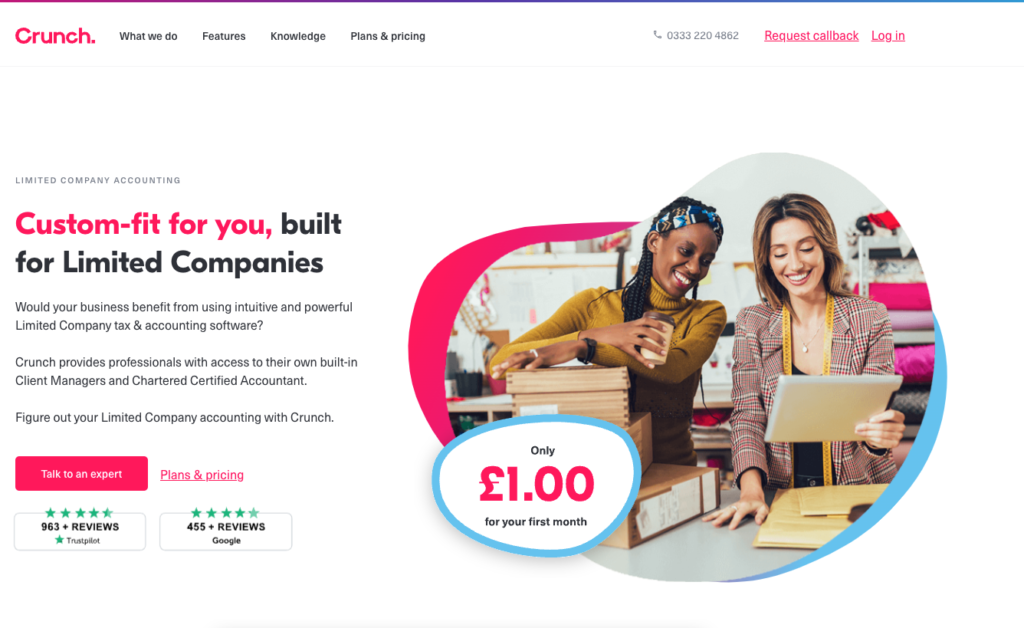

Crunch

Crunch is an accountancy platform that combines traditional accountancy software with qualified accountants. For a set monthly fee you can complete all your bookkeeping, payroll, VAT as well as with filing your annual company accounts. It really is an all in one solution. Prices start from £41.50 per month

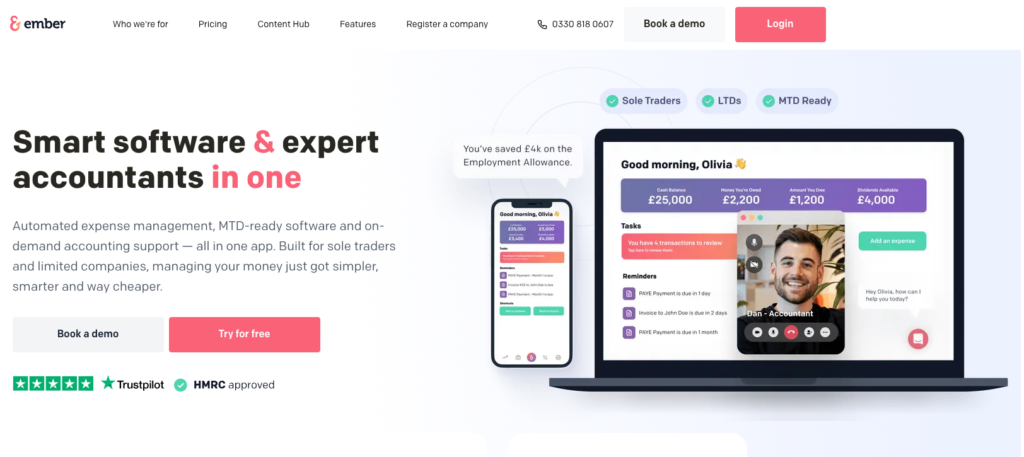

Ember

Ember is another all in one accountancy SAAS platform. Formed in 2017, their mission statement is “Ember takes care of the tax and accounting, so you don’t have to.” With Ember you can complete all the traditional accountancy tasks in a similar fashion to Crunch.

If your turnover is less than £1000 per month, you can get started for free.

Besides the free package, they also offer Pro for £33 per month and unlimited for £66 per month which includes filing of company accounts and confirmation statements.

Ask Other Business Owners

You will likely know other people that run small businesses, or use an accountant in a personal capacity. Ask them who they use and if they’d recommend them. Most people are only too happy to offer advice and a referral from someone you trust is worth its weight in gold.

Ask Friends and Utilise Your Social Media Network

We’re more connected than ever online. Use your social media contacts to ask for recommendations.

The beauty with Social media is that oftentimes, friends will tag the specific contact directly into the post and you can connect straight away and start to discuss your needs.

When taking advice from recommendations on social media, make sure you know what areas the accountant specialises in. An accountant for your friends dog grooming business may not be ideal for your cloud based tech startup.

Here are some questions to ask

- What industries do they specialise in?

- How fast do they respond to questions and queries?

- Are they easy to get hold of via phone/ email?

- What services are they providing?

- payroll

- VAT

- Year end accounts

- bookkeeping

- How often do they speak with their accountant? Do they have regular reviews?

- Does their accountant charge by the hour or do they pay a set fee monthly or annually?

- How much do they pay for their accountant?

- Would they recommend them?

Find an Accountant Using Xero and Quickbooks Search

If you are using a traditional accountant, the chances they’ll recommend using either Quickbooks, Xero or another accounting software package.

Quickbooks and Xero are both excellent for small business for bookkeeping and managing your accounting tasks.

Thankfully both offer a directory of accountants that will recommend their software.

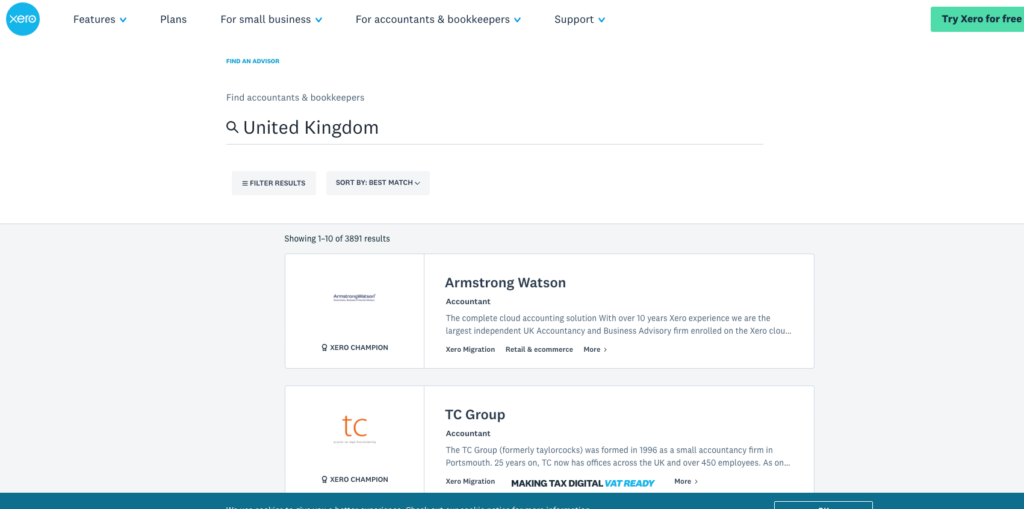

Xero

You can search Xero’s database of accountants and then click from the list to see their profile page for further information.

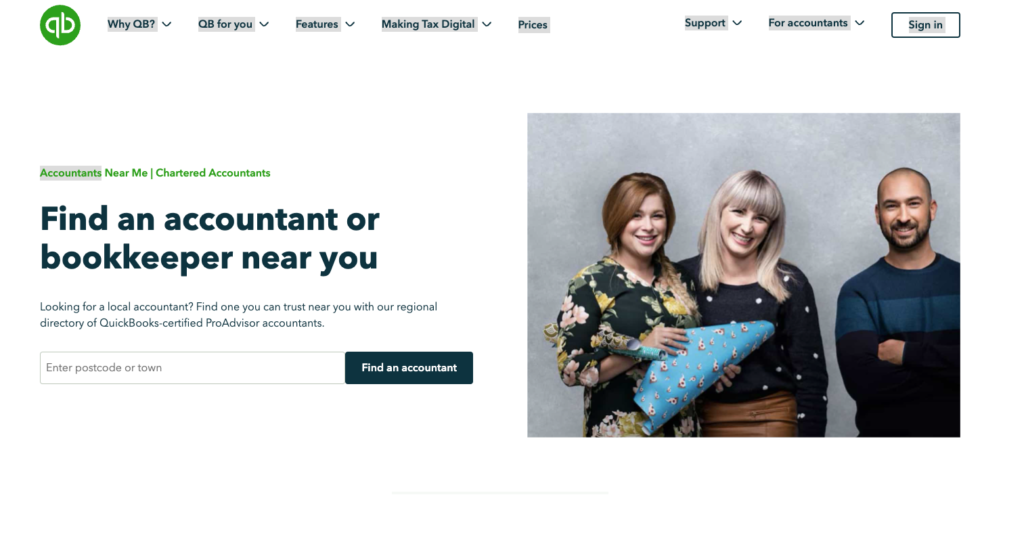

Quickbooks

Quickbooks offers a similar feature. Simply enter your postcode and you can see a list of accountants near you that work with Quickbooks.

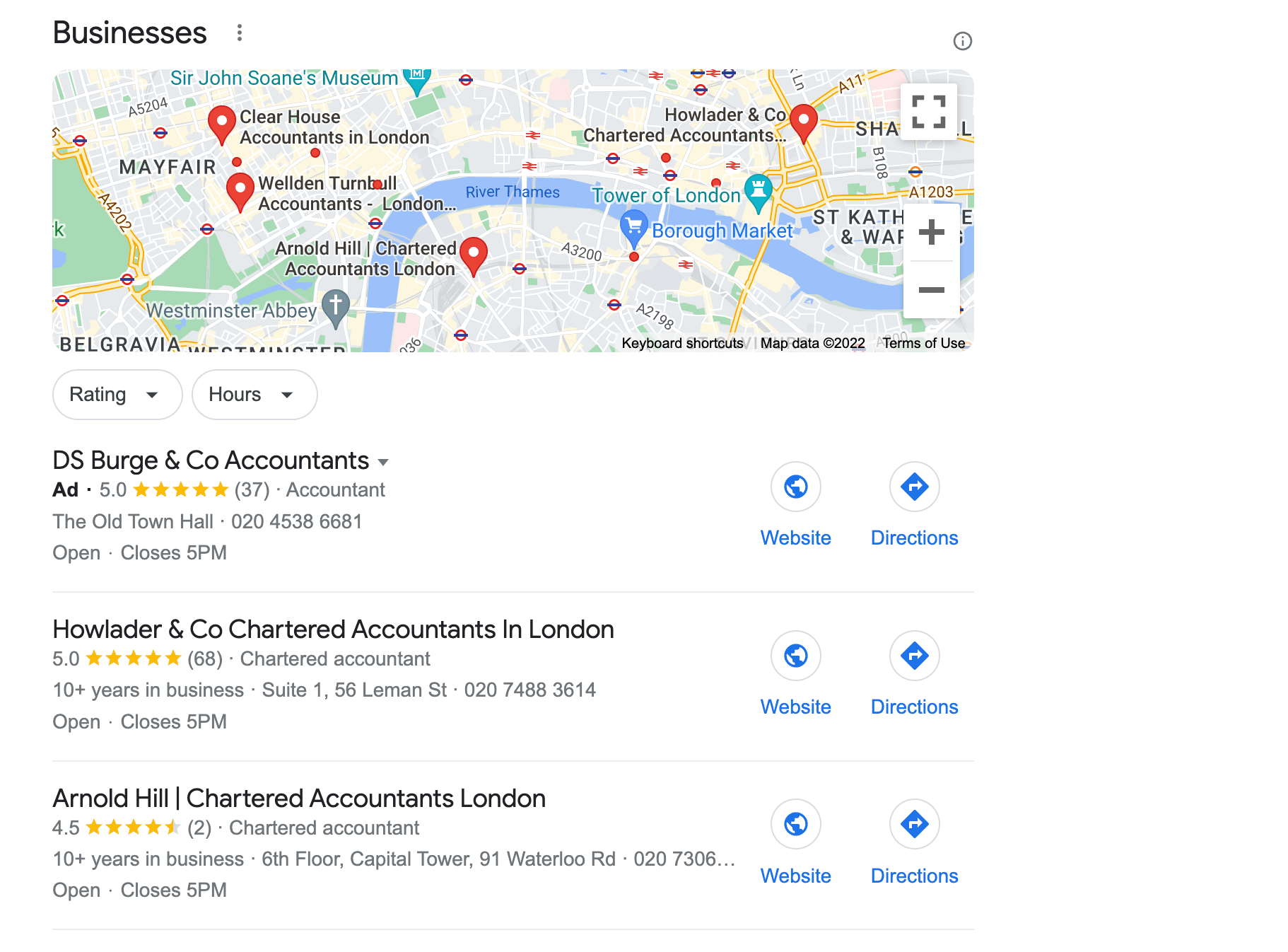

Use Google Local Search to Find an Accountant

If you want to find an accountant that is local to you. Google local search is a good starting point.

Make sure to read through the google reviews to get a broad feeling for how they have serviced their existing clients. Gather together a shortlist of firms that take your interest and conduct some further research.

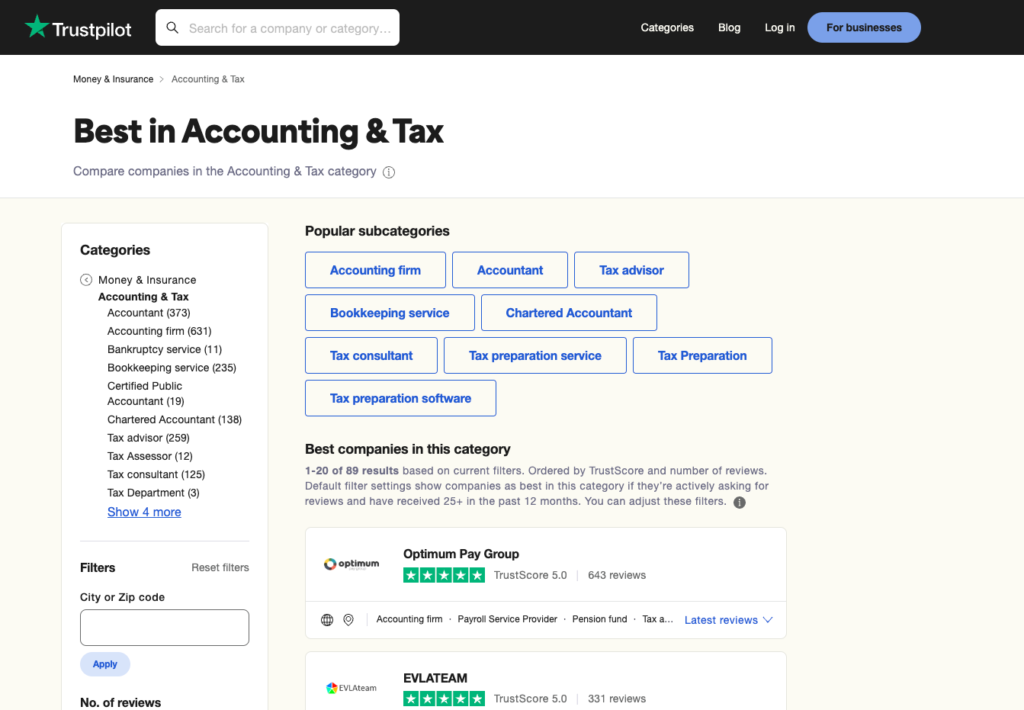

Find Potential Accountants on Review Sites

Review sites are a could sounding board to get an initial sounding board for the reputation of your potential accountant.

Whilst review sites can be plagued with fake reviews, if you search correctly, you can sift through the posts to find genuine feedback from real customers.

When looking through review sites, always take time to filter by the star rating. You want to see the good, the bad and the ugly. If there are negative reviews on there, did the company respond to it? Are they active in managing their online reputation?

Specifically look for people that have reviewed many different products and services rather than just one-off posters.

Trustpilot

Trustpilot is the largest review site in the UK. Simply enter the name of the accountant and location, then filter through the different star rated reviews.

Check to See that Your Accountant is Accredited

You’ll want to check that your accountant is fully qualified in the areas that are important to you.

Check if an accountant is chartered by searching the ICAEW database to see if they are registered.

Other accreditations are the ACCA (Association of Certified Chartered Accountants), a global body for professional accountants and CIMA (Chartered Institute For Management Accountants).

Bear in mind that there is no legal obligation for an accountant to be qualified in any way, so make sure you check this before joining any particular accountancy. If you’re not sure, ask.

Ask For References to Help Find an Accountant

As part of your conversation with any prospective accountant, you should ask for references. Any accountant that is reluctant to provide them should set alarm bells ringing.

If the accountant is professional and is serving their clients well, they should be able to provide a few contacts that they know would be happy to give them a glowing reference.

Don’t be afraid to call them and have a chat about how they are performing.

How Much Does an Accountant Cost?

It’s worth remembering that a good accountant can save you as much as they charge, so don’t just go on cost alone. Below are some approximate figures for what you can expect to pay.

Cost of an Accountant for Self Assessment

The cost of an accountant for simple self assessment will be around £100 – £150. More if you have complex tax arrangements like income from abroad or a second property that you are renting out.

Cost of an Accountant for a LTD Company

The cost of an accountant for a LTD company is harder to define because there are more services that may be required.

To complete year end accounts, expect to pay between £750 – £1250, providing you keep accurate record.

Other monthly fees include

- Bookkeping

- VAT

- Payroll

Budgeting up to £200 per month on accountancy fees should be enough for a startup or small limited company.

Do I Need to Use a Local Accountant Near Me?

When asking the question, do I need to use a local accountant that’s near me, this will all depend on how best you work. Technology has evolved to the point where remote working is now the norm.

It’s just as easy to jump on a zoom call as it is to make an appointment to go and see your accountant face to face.

If you’re happy with phone, email and video calls, then you will have a wider pool of accountants to draw from. This will enable you to choose someone who is more specialised to your specific requirements.

That said, if you like dealing with issues face to face, then don’t discount opting for a local accountant. It has to feel right for you.

What Do You Need an Accountant for?

There are 2 areas that an accountant can help with.

Personal Tax Affairs

Helping to Complete your self assessment tax return and ensure that you are maximising your tax allowances for the tax year that runs 6th April – 5th April.

If you are sole trader, ie, you haven’t setup a LTD company and you receive all income personally you will need to complete a self assessment tax return if you make over £1000 in the tax year.

Accountant For Limited Company

If you have setup a LTD company, there are more responsibilities associated with maintaining its financial affairs. The use of an accountant for a LTD company will probably be required to ensure that all financial reporting and the submission of the correct documents is adhered to.

Submission of a company tax return is the minimum that an accountant can help with. The section below shows all the areas where an accountant can help to ensure that you are compliant and maximising your tax allowances.

What Does an Accountant for a Limited Company do?

If you run a LTD company, an accountant will help the following:

- Payroll

- VAT returns

- Integrate your business with accounting software

- Tax and financial planning

- Bookkeeping

- Minimise tax bills by ensuring you are claiming all tax allowances

- Preparation and submission of company tax return

- Creation of financial reports

- Help setup budgets and manage cashflow

Do you Need an Accountant for Self Assessment?

If you are just starting out as an individual in your spare time, you can probably complete a tax return yourself and won’t need an accountant for self assessment.

This is providing you don’t have any complex tax affairs like overseas income, income from a separate property, or are claiming entrepreneurs tax relief.

If you earn under £1000 per year from your self employed income, you don’t need to report it, so won’t be required to complete a self assessment return.

When you make over £1000 in the tax year you will need to complete a self assessment tax return.

Are your expenses are less than £85,000 per year? If so, you don’t need to enter individual expense amounts, just an overall figure. (But you will still need to record them for your own records)

Do You Need an Accountant for a LTD Company?

The complexity of running a LTD company is far greater than that of a sole trader and employing the services of an accountant is highly recommended.

A good accountant will help to make sure that your company is as tax efficient as possible and could end end up saving you more than they charge.

When you first setup your LTD company there can be a lot of elements that you need to get in place, like setting up your payroll, registering for VAT and getting started with an accounting software package like Xero or Quickbooks.

Having a professional accountant to walk you through all that’s required can stop you from falling foul of any regulatory issues and it’s likely that you’ll need one anyway to file your year end accounts, so finding a good one early can get you off on the right foot.

If you have setup a LTD company and are a director, you will also need to complete a self assessment at the end of the tax year. If you are a small business, you can often get the same accountant to do both for you.

Summary

This guide shows you how to find an accountant in the UK. By using these 9 simple tricks you can cut out the dross and find and focus on finding an accountant that will get your finances in order. Below are the key takeaways

- Use an accountancy marketplace

- Look at Accountancy SAAS solutions

- Ask other business owners and utilise your social media network

- Check Xero and Quickbooks database

- Use Google Local search and then check Trustpilot

- Check your accountant is accredited

- Not opting for a local accountant, will give you a wider range of accountants to choose from

- Expect to pay around £150 for self assessment and £1,200 for limited company accounts